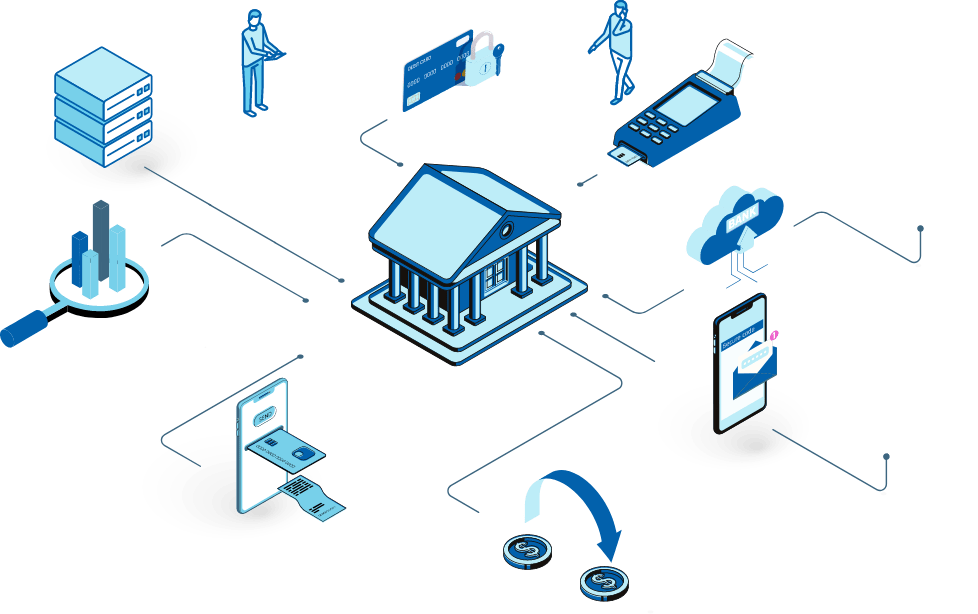

In today’s rapidly evolving financial landscape, core banking solutions have emerged as the backbone of digital transformation in banking. The integration of simple core banking software into financial institutions has revolutionized the way banks operate, offering unprecedented efficiency and customer satisfaction. This article delves into the significance of core banking solutions, their key features, and their transformative impact on the banking sector.

The Evolution of Core Banking

Core banking solutions have undergone significant evolution over the past few decades. Initially, banks relied on manual processes and standalone systems, which were time-consuming and prone to errors. The advent of simple core banking software marked a turning point, enabling banks to automate and streamline their operations. This transition enhanced operational efficiency and allowed banks to provide a more seamless and integrated customer experience.

Key Features of Core Banking Solutions

1. Centralized Data Management

Core banking solutions centralize all banking operations and data management into a single system. This centralization allows for real-time processing and updating of transactions, which is crucial for maintaining accuracy and efficiency. Banks can access customer information, transaction histories, and account details from a unified platform, reducing redundancy and improving decision-making.

2. Enhanced Security and Compliance

In an era where data breaches and cyber threats are rampant, the security features of core banking solutions are paramount. These systems are designed with robust security protocols to protect sensitive customer information. Additionally, they help banks comply with regulatory requirements by providing tools for risk management, reporting, and audit trails.

3. Customer-Centric Services

One of the most significant advantages of core banking solutions is their ability to enhance customer service. With simple core banking software, banks can offer a wide range of customer-centric services, such as personalized product recommendations, instant loan approvals, and real-time account updates. This level of service fosters customer loyalty and satisfaction.

4. Integration with Digital Channels

Modern core banking solutions seamlessly integrate with various digital channels, including mobile banking, online banking, and ATMs. This integration ensures that customers can access banking services anytime, anywhere, thereby enhancing convenience and accessibility. It also allows banks to offer innovative digital products and services, such as digital wallets and peer-to-peer payments.

The Impact of Core Banking Solutions on Operational Efficiency

5. Streamlined Operations

Core banking solutions automate numerous banking processes, such as transaction processing, account management, and customer onboarding. This automation reduces the need for manual intervention, minimizing errors and speeding up operations. As a result, banks can handle higher volumes of transactions with greater efficiency.

6. Cost Reduction

Core banking solutions contribute to significant cost savings by streamlining operations and reducing reliance on physical branches. Banks can cut administrative expenses, reduce paper-based processes, and optimize resource allocation. These cost savings can be reinvested into other business areas, such as innovation and customer service.

7. Improved Decision-Making

Access to real-time data and advanced analytics capabilities empowers banks to make informed decisions swiftly. Core banking solutions provide comprehensive insights into customer behavior, market trends, and financial performance. This data-driven approach enables banks to develop targeted strategies, mitigate risks, and capitalize on emerging opportunities.

8. Support for Emerging Technologies

Core banking solutions are pivotal in supporting the integration of emerging technologies, such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT). These technologies enhance various aspects of banking, from fraud detection to personalized customer experiences. For instance, AI-powered chatbots can provide instant customer support, while blockchain ensures secure and transparent transactions.

Conclusion

Core banking solutions are indeed the backbone of digital transformation in the banking sector. The integration of simple core banking software has empowered banks to enhance operational efficiency, improve customer service, and drive innovation. As the financial landscape continues to evolve, the adoption of robust core banking solutions will be crucial for banks to stay competitive and meet the ever-changing demands of their customers.